IN PARTNERSHIP WITH SPRY FINANCE

A Lifetime Mortgage releases equity in your home which will help the next generation get settled …

Tom and his wife Charlotte (not their real names) live by themselves in a four-bedroom house in South Dublin which they bought some 40 years ago. Over the years, they’ve done some work on the property – the garage became a study, their BER was improved with external cladding and they’ve installed solar panels. By and large however, it’s still the same family home that they moved to when their children were 12, nine, two and just a newborn.

Tom is 73 now, retired from his position as a company director, and Charlotte is 77, also retired from work as a carer. As Tom says, with the pension provision that they have, they’ve enough for their needs – he’s a big fan of the sun, which is not a defining characteristic of a life in Ireland, so this year they’ve had two getaways.

Their children moved out, all living reasonably locally, and there have been weddings, families, house purchases and setting up businesses of their own. Unfortunately for one of their daughters, however, Covid came along and her business as a beautician – like so many small businesses in the service sector – was unable to survive. When, therefore, her landlord asked her to leave her rental apartment she found herself caught up in the ongoing effects of the housing crisis – both rents and property purchase prices are increasingly unaffordable.

Tom and Charlotte were fortunate enough to have invested in a second home, and had enjoyed it over the years, but prior to Covid had made the decision to sell, realising a significant sum, even after tax.

Having gifted some of the proceeds to their children, they made the decision that they would use the rest of the money to help their daughter get onto the property ladder – on the understanding that this was her inheritance and that her siblings will share the value in the family home when the time comes. Their daughter found a property in Co Wicklow, however, even with Tom and Charlotte’s gift and her own contribution, they were still €100k short.

It was at this point that Tom recalled seeing an advertisement for the Spry Finance Lifetime Mortgage, so he got in touch. They were reassured that their home’s value of €650k was well above Spry’s minimum requirements. Tom, of course, wanted to be sure that there would be no issues from his side in making the loan arrangement. He did extensive research, asked the necessary questions, got a full understanding of the product and – importantly – spoke to all of his children and solicitor about what he and Charlotte intended to do.

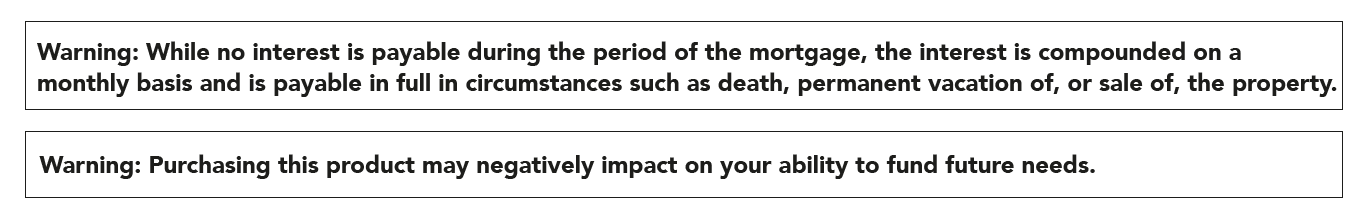

Their lifetime loan of €100k was for the amount required (less than the maximum amount approved) which enabled their daughter to complete the purchase of her first home. She is now hoping to start up her beautician’s business again in the coming months. Like all Spry Lifetime Mortgages, no repayments are required, but Tom and Charlotte are among a growing number of people who are choosing to make optional repayments. These can be up to 10% of the original loan amount each year and help manage the loan balance over time.

Tom says that the remaining equity in their home is for their other children and – having looked at the projections of how a loan might grow over time – making repayments is of key importance to him and his family. As part of his agreement with their daughter, she pays him an amount each month, which he sets against the interest on the loan. From Tom’s point of view, he and Charlotte are busy enough – gardening, housework, family visits, holidays and the needs of a little dog – they get out and about and they’ve got the lives they want. As he says, they didn’t really need all that money and they’re happy to have been able to provide a living inheritance where and when it was needed.

FEATURES OF A LIFETIME MORTGAGE

• A Lifetime Mortgage allows you to release money from your principal private residence, tax free, without having to sell it.

• You retain full ownership of the property.

• The property must be in the Republic of Ireland.

• Property must have a minimum value of €225,000 outside of Dublin and €300,000 in Dublin.

• The amount you can borrow is calculated as a percentage of your home’s value and depends on your age.

• Lifetime Loans are designed for people aged 60 years and over – e.g. customers aged 60 may borrow up to a maximum of 15 per cent of the value of their property.

• The loan is usually repaid from your estate or the sale of your property.

• You can choose to make optional repayments up to 10 per cent of the original loan balance yearly to help manage the loan balance.

• The Spry Finance No Negative Equity Guarantee means you will never owe more than the value of your home. For more information, visit www.spryfinance.ie or call 01 5822570

Seniors Money Mortgages (Ireland) DAC, trading as Seniors Money, Spry Finance and Spry is regulated by the Central Bank of Ireland.