Many employees are confused about how best to manage their share incentives, even when it’s a significant portion of their wealth. The team at Goodbody explain what you need to know …

It’s always nice to have options, and it’s especially nice to have share options. However, many employees are confused about how best to manage their share incentives, even when it’s a significant portion of their wealth. As a result, the majority take a very passive approach. Big mistake! In this article we will outline some of the issues you should be aware of in order to best manage and maximise this important asset in the long and short term.

It’s worth bearing in mind that not all share incentive schemes are the same and the tax implications differ depending on the scheme. What applies in your last company scheme might not apply in your current company. Read the documentation given to you by your human resources department and understand your scheme. However, taking three types of common schemes, the following illustrates how differently they are taxed.

1. Stock Options:

Stock options give (grant) an employee the right (without obligation) to buy (exercise) a stock at an agreed upon price at a future point. If an option is not capable of being exercised more than seven years after the date on which it was granted, it is called a “short option” and no charge to tax arises on the date it was granted. If the option is capable of being exercised more than seven years from the date of grant it is called a “long option” and a charge to income tax may arise on the date it was granted. Typically, companies issue short options, meaning a tax charge should not arise on grant date.

Where the options are exercised down the line, income tax, USC and PRSI are due and must be paid to Revenue within 30 days of the exercise of the option. Exercising the option is the employee exercising their right to purchase the stock at the predetermined price and so following exercise, the employee then owns the stock.

Where the employee subsequently sells the stock at a gain, Capital Gains Tax (CGT) at 33% also needs to be calculated.

2. RSUs (Restricted Stock Units):

A RSU is a grant/promise from your employer that on completion of a vesting period, you will receive either shares in the company or the cash equivalent of those shares. Income tax, USC and PRSI is charged on vesting of the shares or where the shares or cash pass on a date prior to the vesting date on that earlier date.

On a subsequent sale of the shares at a gain, CGT at 33% also needs to be calculated.

3. Approved Profit Share Scheme

An Approved Profit Share Scheme is a mechanism whereby a company gives shares to its employees and the employee is, subject to certain conditions, exempt from the income tax charge on the shares (up to a maximum annual limit). Whilst there may be no income tax on the receipt of the shares, USC and PRSI are still due, as well as CGT on a gain on a subsequent sale of the shares.

The reason most people leave their share incentives alone? A three-letter word: Tax.

Why Holding Becomes High Risk

The reason most people leave their share incentives alone? A three-letter word: Tax. Nevertheless, tax (or deferring it) should not be the main reason for holding on to a stock. Remember stocks can go up and down dramatically.

Concentrated stock positions, compared to diversifying stock is a high-risk investing strategy. For example, at the beginning of the pandemic, many companies that might have been regarded as safe, secured investments but then quickly lost 50% in value. No matter how secure a company stock (or indeed just one sector) appears, holding a high percentage in just one name may be an unwise risk.

Reduce Risk: Diversify!

A diversified portfolio is the strongest weapon you have against volatility, the risk metric which measures the swings in returns above and below the average return. When volatility is high, it reduces the overall compound growth rate and negatively impacts future growth.

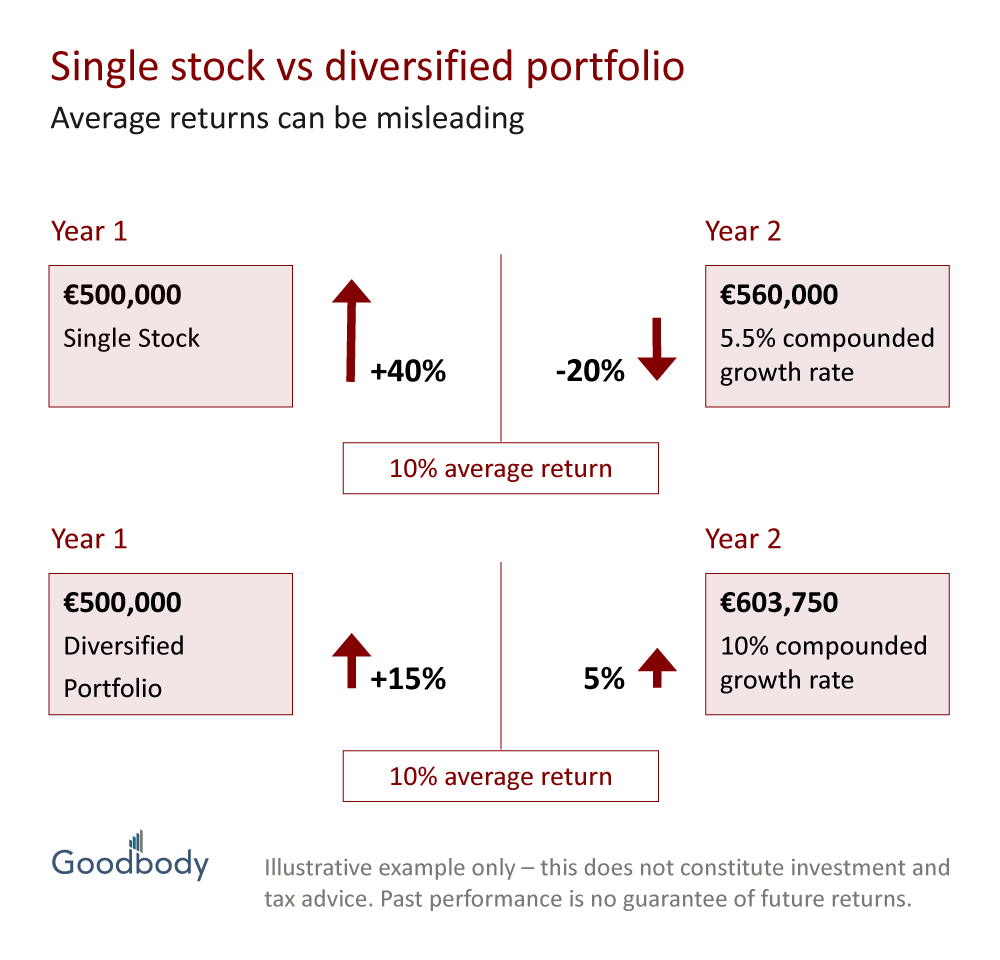

In the long term, your compound growth rate will amount to more than your average return. As you can see in the example below:

-A single stock and a diversified portfolio can both have an average return of 10% per annum

-The single stock increased 40% in year 1 and fell 20% in year 2, giving a compound growth rate of 5.5%.

-The diversified portfolio went up 15% in year 1 and up 5 % in year 2, resulting in a 10% compound growth rate and a difference of over €100K.

The more the return of an investment fluctuates, the greater the impact on the compound growth rate, resulting in lower future wealth.

Past Performance is not Future Performance

Some investors have an emotional connection to a stock due to a close relationship with the company you work for or because you inherited the stock from a loved one. We urge these investors to look at the facts and consider the risk. You might just be bullish on the past performance of the stock and happy with the dividend yield. Just remember: past performance is not an indicator of future performance!

Have a Plan

While you might think of your share incentives as low risk, they could be high risk depending on the value of your position and what it represents in the totality of your financial wealth. Have a plan and get help from a financial advisor. They are best positioned to advise you, free of emotional attachment or bias towards past stock performance.

The first steps towards a plan can seem overwhelming but the team at Goodbody can help with a no commitment, confidential chat. Talk to us today about your share incentives and creating long-term prosperity. Contact Jennifer Graham at Jennifer.M.Graham@goodbody.ie.