IN PARTNERSHIP WITH SPRY FINANCE

A Lifetime Loan is a way to release equity in your home. Here is how one woman went about it …

Nuala, (not her real name) is 77 and lives alone in an apartment in North County Dublin where she moved soon after her retirement to be closer to her large extended family. Although Nuala is single and has no children of her own, she is one of nine siblings and – at the last count – she is proud to have 25 nieces and nephews and over 40 grand-nieces and nephews. Sometimes, she says, it’s hard to keep up.

She had a successful career in banking before her retirement, one that she combined with being a carer for her mother – a role which, as is the way with these things, became increasingly time-consuming. Nuala would be the first to say that it wasn’t the easiest time, but she came out the other side and – in her 60s – began to live a different life.

With a background in banking, Nuala is well-versed in financial matters and manages her money effectively. While she has always ensured her finances are stable, any surplus is thoughtfully allocated to support the charities she cares about.

It was the unexpected – and untimely – loss of a close family member that prompted her to think, she says, “I want to make a difference to my own life”. The question was how to finance making that difference.

Nuala owns her apartment mortgage-free and was aware of the Spry Finance Lifetime Loan as a way of raising money by securing a loan against the value of her home. She also knew that approaching a traditional bank, given her age, was unlikely to be an option.

First thing – and with her banking background – Nuala did her research, looking into Spry Finance and its background, and talking to people she knows in finance and, of course, her solicitor. She got further information about the product and the process of arranging a Spry Lifetime Loan, and she spoke with the two of her nieces who are appointed to have power of attorney over her affairs should the need arise.

Both of them were extremely supportive and told her to go for it, pointing out that not only is her money hers to do what she wants with, but that she’s worked hard for it and should enjoy it while she can. The big thing for her, Nuala said, was to ensure that “no-one has to pay my loan when I die”.

“I want to make a difference to my own life.”

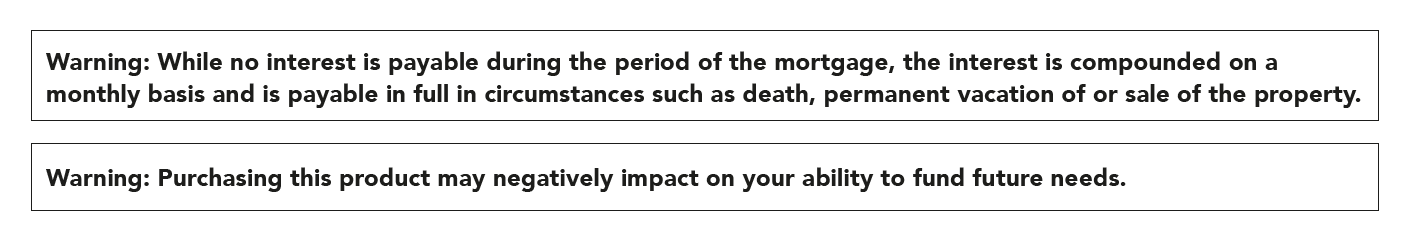

She’s not going to make any repayments on the loan – “after all” she says “why would I get it and then give it back” – which means that the interest on the loan is compounded and the loan balance grows. Spry’s No Negative Equity Guarantee ensures, however, that – even if the value of her property were to be less than the loan balance – nothing further would be payable when the time comes.

“There’s nothing there,” Nuala says “that isn’t in any normal loan offer, and no-one should have an issue with the product. Having a banking background, I really scrutinised every little piece and the thing is – there really is no small print”.

Earlier this year, Nuala arranged to borrow just over 30% of the value of her apartment and, she says, she’s “settling into the fact that there’s money there that I can use”.

And her plans? Well, warm and dry climates improve her health, so winter holidays and travelling to see family living abroad are priorities. “I like the South of France, Italy and Spain and I’d love to go on a Nile cruise. I’ve got family in the Canaries and I’m told Morocco is an adventure” she says.

She’s also earmarking money for home improvements. “I’m going to get some work done on my kitchen – I’m 77, I’m five feet tall, and I need things where I can reach them!” And, she adds “in the winter, public transport is terrible – but now I don’t have to keep a tab on the taxis!”

FEATURES OF A LIFETIME LOAN

• A Lifetime Loan allows you to release money from your principal private residence, tax free, without having to sell it.

• You retain full ownership of the property.

• The property must be in the Republic of Ireland.

• Property must have a minimum value of €175,000 outside of Dublin and €250,000 in Dublin.

• The amount you can borrow is calculated as a percentage of your home’s value and depends on your age.

• Lifetime Loans are designed for people aged 60 years and over – e.g. customers aged 60 may borrow up to a maximum of 15% of the value of their property.

• The loan is usually repaid from your estate or the sale of your property.

• You can choose to make optional repayments up to 10% of the original loan balance yearly to help manage the loan balance.

• The Spry Finance No Negative Equity Guarantee means you will never owe more than the value of your home.

For more information visit www.spryfinance.ie or call 01 5822570.

Seniors Money Mortgages (Ireland) DAC, trading as Seniors Money, Spry Finance and Spry is regulated by the Central Bank of Ireland.