Recognising the unique financial challenges women face throughout their lifetime is critical in ensuring a financially resilient future. Armed with education and a plan, women can feel more confident about their financial goals and how they can achieve them. Recently, we invited submissions for a complimentary bespoke financial plan devised by the all-female advisory team at Goodbody. We received numerous entries, and selected three personal stories which feature challenges that many of us will face during our lifetime. Here we present one such story.

In her own words: the financial challenge

Money matters were not at the forefront of my mind when my marriage broke down in 2009, rather my focus was the wellbeing of my children. Fifteen years on, I am proud to say I have put my four adult children through third-level education, and they are doing well in life.

I have accumulated several property assets both personally and via a pension structure and, despite the difficult recession years that followed my divorce, I worked hard and managed to hold on to my assets. They are all now owned free of any debt – but I feel asset rich and cash poor.

I know my job consumes me, and I lack work-life balance. So, I would like a financial plan to help me free up cash flow so as to enjoy my life outside of work; better understand my pension asset and how it will provide me an income in retirement; and retain some assets to pass on to my children as an inheritance.

Rachel, 55

Divorced mum of four adult children and business owner

The financial situation

Divorce can be one of the most challenging life events to navigate due to the conflict inherent in marriage breakdowns and because of the technical difficulties of arriving at a financial outcome that is equitable for both parties.

Financial advisors see it up close. Even in divorces where there is little personal acrimony, dividing up wealth and property is a delicate process with major consequences – and so, once you navigate a divorce, it is really important to consider the steps you can take to safeguard your future financial security.

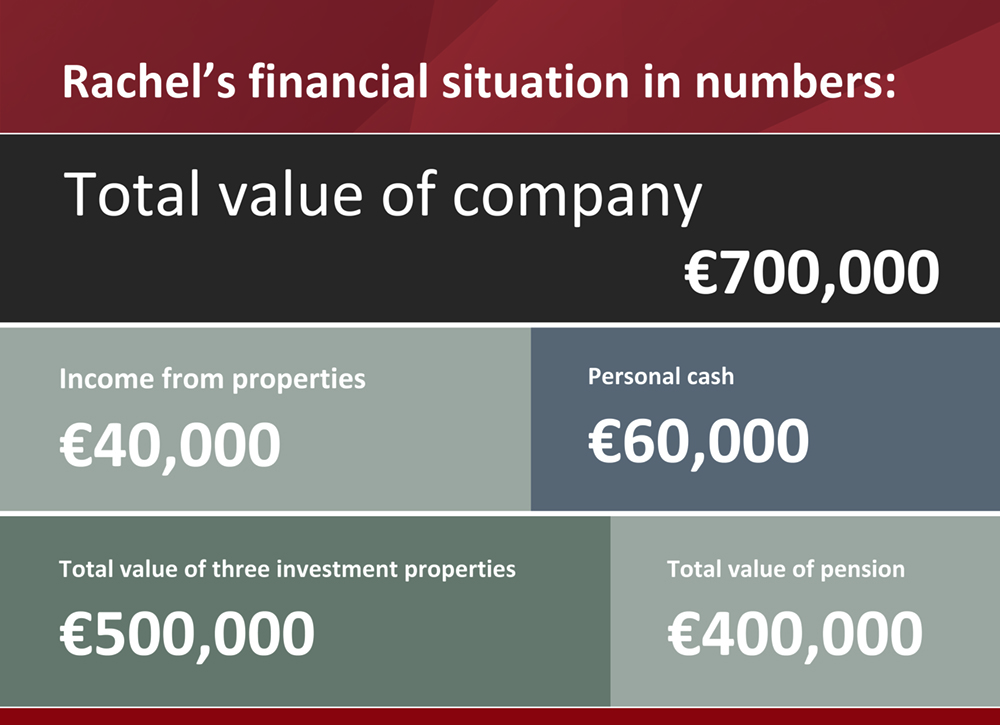

That’s what Rachel is seeking to do. Since her divorce, she has successfully ran her own business, held on to her property assets and provided for her children. Today, her business is doing well. Rachel takes a salary of €50,000 per year from the company and generates an annual income of about €40,000 from the three properties she owns. That takes her total yearly income to €90,000 per year. Rachel’s annual living expenses amount to roughly €45,000 per year and she has no mortgage or short-term debt. In addition, she is carrying approximately €50,000 of CGT losses.

Over the years, she has focused her investments on the property industry: she owns the building that her company trades from and this and her other properties have a current market value of circa €500,000 (excluding her main residence). Rachel has a pension in place with a total value of €400,000 – and it holds a property as its main asset. Aside from her main residence, her other personal asset is cash of €60,000. Rachel hasn’t valued her business which is set up as a company, but she thinks it would be worth €700,000 given the brand that she has established and her client base. Currently, Rachel thinks there is surplus cash in the business of €150,000 and this is not included in the €700,000 valuation. Therefore, her assets are worth in the region of €1.66m (excluding her main residence) when the value of the business is included in her assets.

Given that her children are no longer financially dependent and as she is debt-free, Rachel has no existing life insurance in place. However, she has a critical illness policy which would pay her a lump sum if she was diagnosed with a severe illness, but she hasn’t thought about what would happen to her company if something happened to her.

The Goodbody advice

Our plan to enable Rachel to realise some cash flow, ensure her pension provides an adequate income in her retirement and retain some assets to pass on to her children as an inheritance focussed on four key areas:

1. Extract cash from her company: in the short-to-medium term, Rachel wants to realise some cash flow, and so, we considered a number of options with her, including the sale of one of her properties to her company and thinking ahead, we also examined tax reliefs that may be available to her on exit from her business. In this case, it may make sense to sell her existing business premises to her company. This would allow her to retain the asset, which she wishes to do for her children’s future, and give her access to cash in the short term. As she is carrying CGT losses, she could use these losses against the gain on the sale of the property to the company, which will help reduce any potential tax bill on sale that may be due. However, the company would have stamp duty to pay on this proposed transaction. While this would be a short-to-medium term solution, Rachel would need to consider how the sale of this property to the company would impact on the tax reliefs that may be available to her when she decides to exit her business. Given her age, the team considered this and her plans for the business in the future and if a sale or liquidation of the company was an option. CGT Retirement Relief and CGT Entrepreneur Relief would be very valuable tax reliefs for her when she decides to exit the business provided the conditions for the reliefs are satisfied. In fact, CGT Retirement Relief is an option for her now, but she does not wish to dispose of the business just yet.

2. Continuing her pension contributions: as we referenced, Rachel has a pension, and it is important that, if she does not wish to sell or liquidate the company in the short term, that she continues her pension contributions over the next five years as it will impact the overall value of her pension. This will give Rachel more options when it comes to the amount of income she will have during her retirement years. Employer pension funding is a tax efficient way of moving surplus cash from her business into her personal name via her pension structure and it was suggested that some of the surplus cash in the business could be used for this purpose. Unlike when Rachel withdraws her income from her business, there is no income tax, PRSI, or USC on an employer contribution to her pension. Luckily Rachel secured a nil Pension Adjustment Order over her pension when her divorce was finalised such that the full fund remains for her benefit. If Rachel were to sell her company or liquidate it in the short term, given her age she would also be able to access her pension fund which would free up cash for her in the form of a tax-free lump sum of €100,000 (based on the current value of her pension fund) and she could then grow her remaining pension fund tax free until the age of 61.

3. Diversifying her assets: Rachel has €900,000 invested in property, shares in her company worth approximately €700,000 and €60,000 in cash. This equates to 54 per cent of her investments in the same asset class. In fact, the shares in her company could be considered an equity-like investment such that 96 per cent of her assets are in high-risk assets. It would be prudent for Rachel to diversify her assets because in the event of a downturn in the Irish property market, she would be very exposed – and this could severely impact her retirement plans and the ability to generate the income she requires. Her investment in property means a sizeable portion of her assets are very illiquid. That means, if she wished to realise cash, it could take some time. However, if she diversifies into other asset classes, she’d be able to turn them into cash quicker. Diversifying her assets will also protect the inheritance she wishes to provide her children.

4. Inheritance planning: Rachel was keen to understand the likely exposure to inheritance tax that her children would face, and the team were able to estimate the funds that her children would need to have to pay their CAT bill on inheriting her current assets. In the absence of a sale or liquidation of the business, her asset base is illiquid for the next generation and the team were able to suggest how she might help her children meet their CAT liability. The team also recommended that Rachel draft her will and set up an Enduring Power of Attorney.

A note on life cover and business protection: the team also considered Rachel’s options given that she does not have adequate cover in place. It was decided to revisit this once she considered the best option for her to realise cash flow.

A final thought…

Divorce can be a lengthy process fraught with both financial and emotional strain as you make important decisions with significant long-term consequences under stressful conditions. It’s a hardship that no one should have to navigate alone. That’s why at Goodbody we recommend that you reach out to your financial advisor to help you navigate this challenging life event and to prepare for a brighter future. We understand that every divorce is unique and it’s crucial to seek legal and financial advice that is tailored to your individual needs.

Rachel has successfully navigated a divorce – and is now putting structures in place for her future. Overall, Rachel is financially in a good position, but there are some steps she can take today in the areas of cash flow management, pension management and diversification of assets to ensure all of her hard work will set her up for a comfortable and well-deserved retirement.

Please read: For confidentiality purposes, names, monetary sums as well as any other personal details including identifiable characteristics of individuals have been changed. These case studies are illustrative examples only – they do not constitute investment or tax advice or a personal recommendation as they do not take into account the investment objectives, knowledge and experience or financial situation of any individual. Not all recommendations are necessarily suitable for all investors and Goodbody recommend that specific advice considering your personal circumstances should always be sought prior to making any investment. Figures quoted are estimates only. Past performance is not a reliable guide to future performance; neither should simulated performance. The value of your investment may go down as well as up. The value of securities may be subject to exchange rate fluctuations that may have a positive or negative effect on the price of such securities, sales proceeds, and on dividend or income interest.

This is a marketing communication. Nothing in this publication constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Goodbody Stockbrokers UC, trading as Goodbody, is regulated by the Central Bank of Ireland and Goodbody Stockbrokers UC is authorised and regulated in the United Kingdom by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the group of companies headed by AIB Group plc.